I got a bill in the mail the other day for $1.08, it was for a credit card that I haven’t used in over six months and I guess there was some left over interest that just won’t go away. It costs $1 to send that letter, and I’ve ignored it a few times already because going out of my way to pay a $1.08 just doesn’t seem worth it. I have to go into the store to pay it and there is no phone number to call anyone to straighten this out. I’d probably spend more money on gas getting there. If you’re wondering, I ended up throwing the bill in my bag and paying it when I was already there for something else but what a giant hassle!

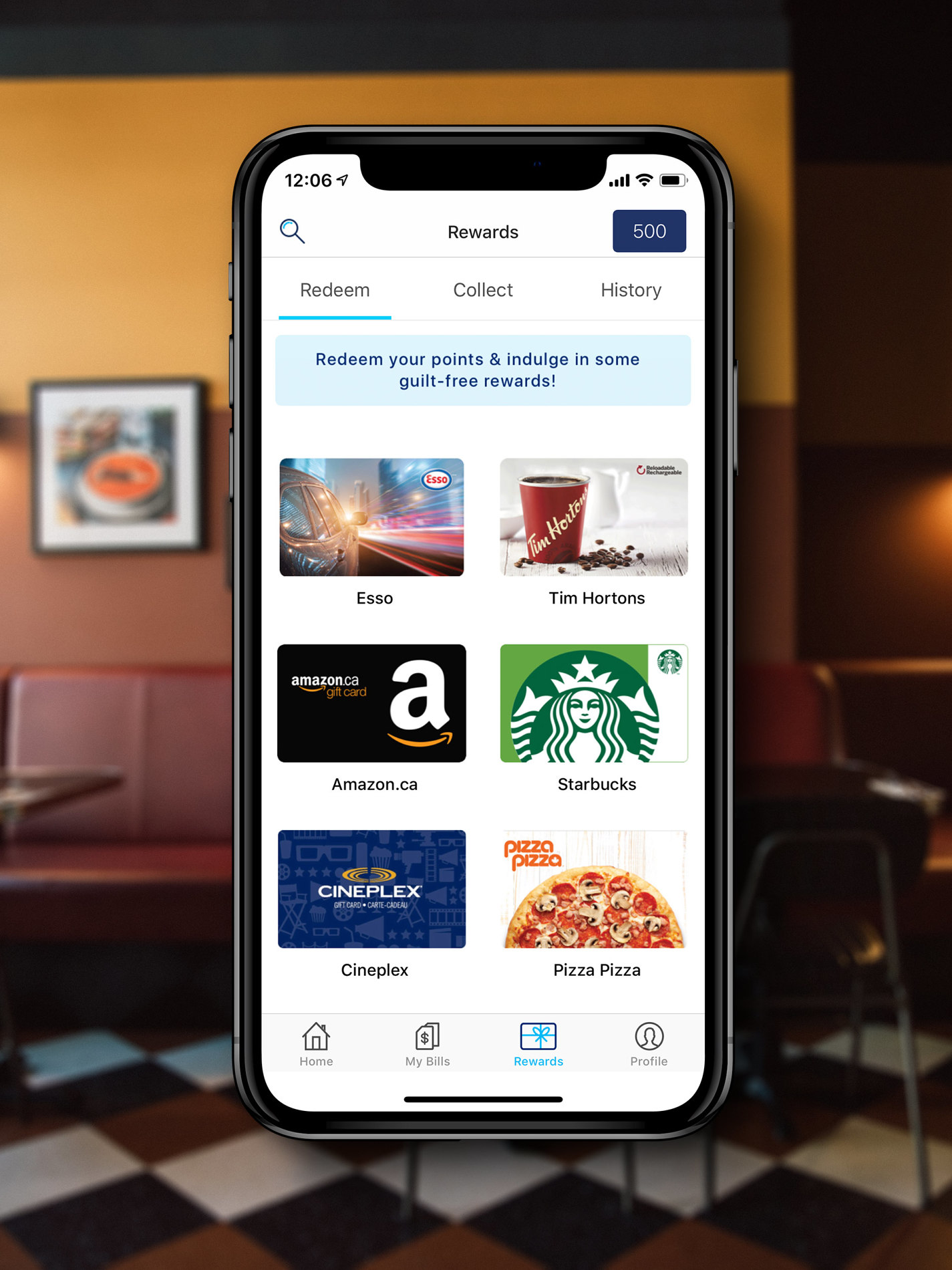

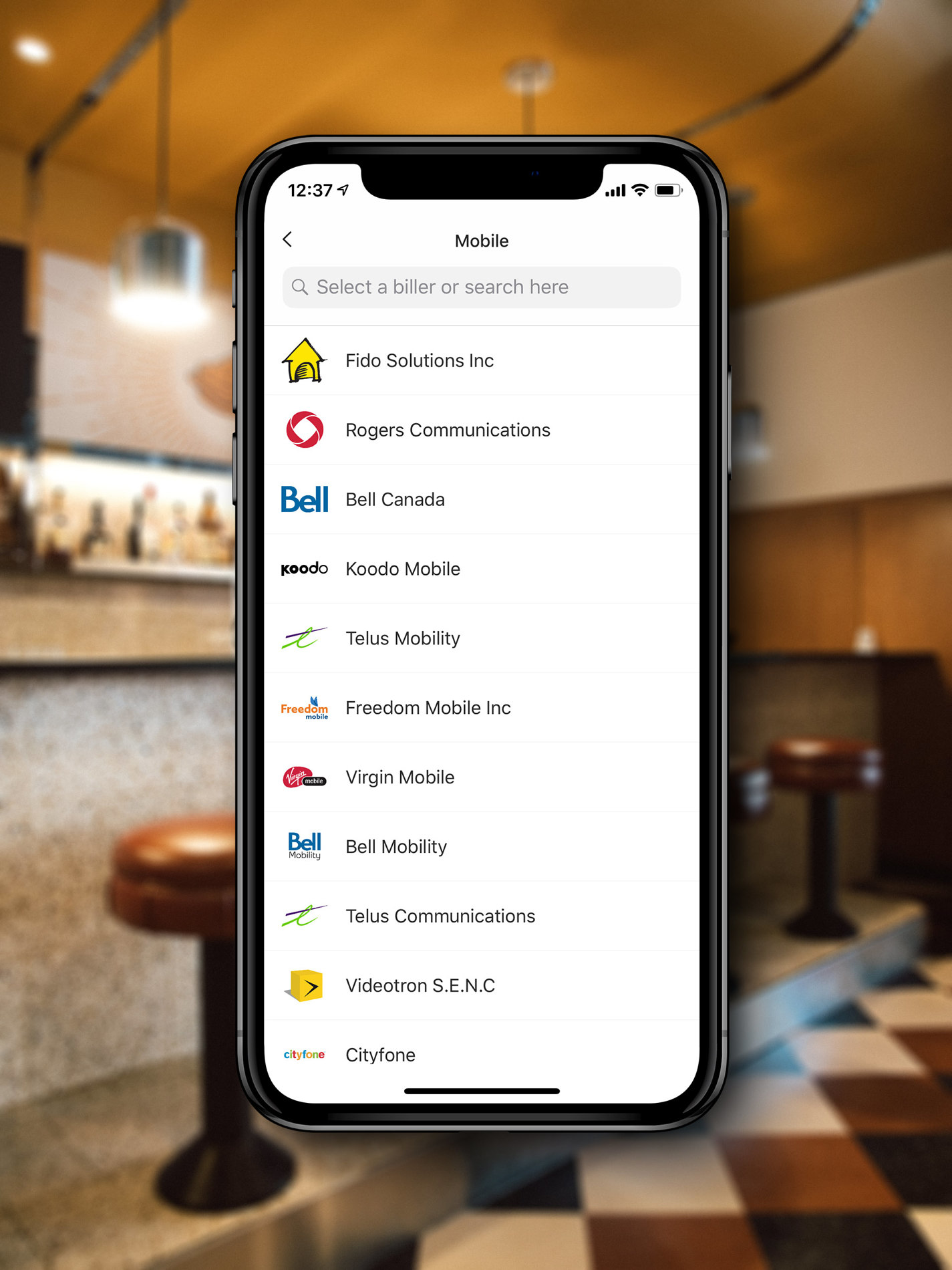

This isn’t the only hassle of this particular adulting activity. When I think of paying my bills the image of an all American home with a round kitchen table with a mum surrounded by papers, a calculator and a check book comes to mind. Things have definitely changed since those days but they are about to change again, for the better. There is a new app in town that not only makes your bill payment process more streamlined and efficient but it actually rewards you to do it! Paytm. You can now make payments to over 5,000 utility providers, government institutions, telecommunications services and other payees all in one place and every time that you do, you accumulate points that you can later cash in for gift cards to retailers like apple, amazon, cineplex, indigo, hudson’s bay, sephora, esso, uber eats and many many more.

The process is so streamlined that you won’t have to think much about it. By registering your bills within the app you will now have everything in one place, paperless and literally at your fingertips. Paytm even sends their customer reminders when their bills are due and notifies when a regular bill is inconsistent with their previous payments. And if budgeting is your weak spot, Paytm can even help on that front by predicting upcoming expenses! If spending your points on GC rewards is not your thing you can also redeem your hard earned Paytm points back into paying your bills and what more is that when paying with a credit card you are still collecting your points with the bank so… double the points! Paytm also has an exciting new ‘Set it & Forget It‘ feature, so you can schedule all of your bill payments in advance by pre-selecting the date, amount and frequency that you want to pay it. Whether you’re at home or travelling, you never have to worry about missing a bill payment again!

Most importantly the dreaded chore of paying bills has now gotten so easy that I can do it while living my life, I never thought that popping in to the newest hot spots and paying my bills will coincide in my schedule but here we are. No more reminding yourself to take that dreaded bill into the bank, no more ignoring $1 bills for six months because it’s inconvenient (and let’s face it that probably wasn’t the best for my credit score either… oops!) and no more paper! And if you happen to be making your way to Calgary don’t forget to pop into Alumni on 17th, a new diner influenced sandwich shop that will redefine your standard of how you enjoy the all American classic and it’s mighty photogenic to boot!

The Paytm Canada mobile app is available for free download from the Google Play store, Apple Store and at www.paytm.ca

Tags: alumni, calgary, finance, hotspots, Paytm, restaurants, sponsored, tech

You Looking Very Pretty.

Thank you for this finance blog with a great splash of fun and beautiful creativity to live life in a beautiful and abundant ways. I am in the need to begin a official start up in my personal accounting – basic of basics – to prepare for a good accountant down the road. I have received an increase in finances and I want to take the bull by the horns to be accountable, responsible.

Sexy look!